Navy Federal Auto Loan Cosigner

The person who is helping them secure the loan is called the guarantor. Like other lenders however some of the lowest Navy Federal auto loan rates go to new-car buyers who choose the shortest terms.

Consolidation is common with student loans.

Navy federal auto loan cosigner. A cosigner or coborrower can help you qualify for better rates and terms when applying for Navy Federal Credit Union Auto Loan. The maximum loan term for used vehicles is 72 months. Motorcycle and moped loans.

What is co-signing. Get Results from 6 Engines at Once. Existing Navy Federal loans are not eligible for this offer.

This is shorter than the average release period in the student debt industry. Joint Applications Navy Federal allows you to apply for a personal loan with a cosigner. In other words if you fail to make payments the co-signer is legally responsible for making those payments for you.

Hence it is not surprising that Navy Federal student loans require the cosigner to meet similar debtors requirements. The individual who is intending to use the loan is known as the borrower. A co-signer is essentially somebody who vouches for you and is usually a parent whos employed and has a healthy credit history.

Navy Federal Credit Union Used Auto Loans. Late Model Used Vehicles. Keep in mind that the credit-check requirement also applies to cosigners.

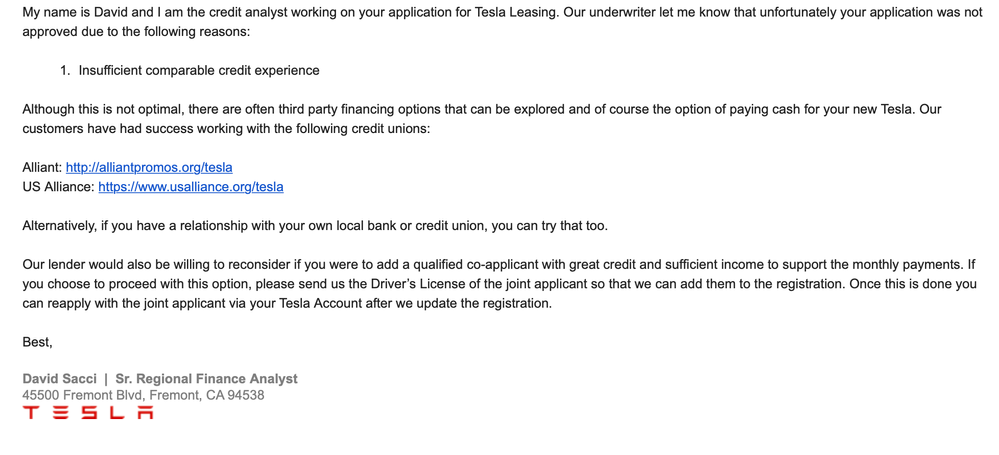

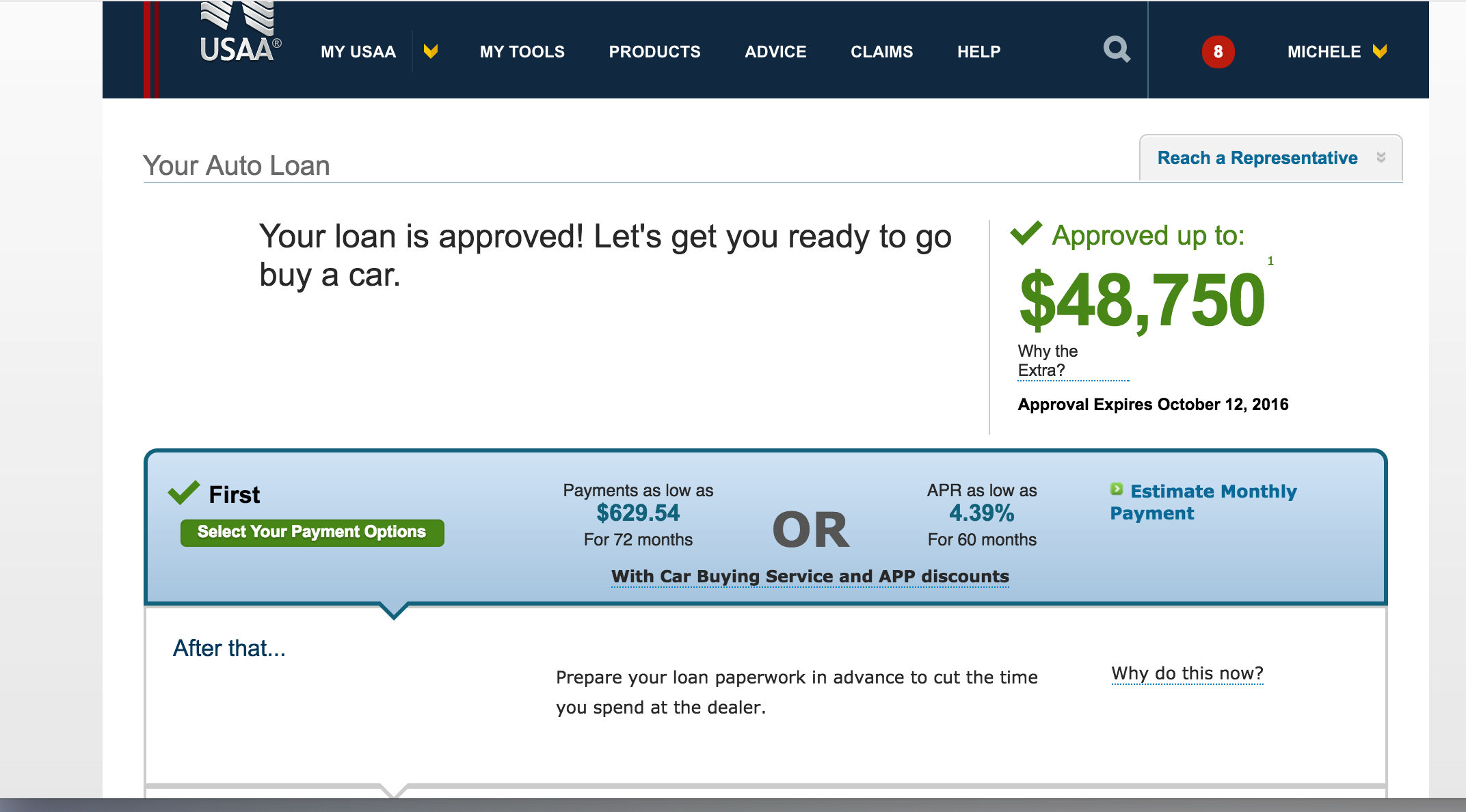

Auto refinance loan must be at least 5000. Everything worked out with USAA. Loan must be open for at least 60 days with first scheduled payment made to be eligible for the 200 which will be credited to the primary applicants savings account between 61 and 65 days of.

NFCU Denied Auto Loan with a Co-signer. Co-signing means that two parties are applying jointly for a loan. Navy Federal offers its members a flexible loan product with multiple loan amounts and repayment terms to choose from plus 247 customer support.

For example the cosigner should also be a US citizen be 18 or older and most importantly get a Navy Federal Credit Union membership. Navy Federal Credit Union Auto Loan does not charge an origination fee for processing your loan application. A co-signer takes on equal responsibility for the loan.

Being a guarantor involves. Know the market value of. Not a bad deal and especially for my first car.

If you dont qualify for a car loan due to a poor or insufficient credit history you might ask someone such as a family member to co-sign the loan with you. The credit union has competitive APRs for used cars too particularly late-model vehicles. 2020 2021 and 2022 model years with 7499 miles or less.

I brought a 2011 Chevrolet Aveo Lt from a woman off craigslist with 37k on the engine for 7200. How to apply with Navy Federal Credit Union. Navy Federal Credit Union Auto Loan will consider borrowers regardless of their employment status if they can prove their ability to repay their obligations.

Minimum loan amount is 30000 for terms of 85-96 months. Keep in mind that the credit-check requirement also applies to cosigners. With a Navy Federal preapproved auto loan youll be better prepared to drive away in your new car.

2020 2021 and 2022 model years with 7500-30000 miles. New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572. Before you go car buying apply online for a low-rate Navy Federal Credit Union auto loan or call 1-888-842-6328.

Used auto financing is available for any vehicle older than three years with loan terms of up to 72 months. This military special may expire at any time. With a Navy Federal pre-approved auto loan youll be better prepared to drive away in your new car.

A qualifying borrower can use the consolidation loan to pay off the loan you cosigned. The lowest APR for a used auto loan currently starts at 389 percent for terms up to 36 months jumping to 529 percent for loans terms between 61 and 72 months. Another option is to have the other borrower refinance the loan into their name.

To qualify for a refinance the borrower needs to have a good credit history and enough income to make the new loans monthly payments. All other vehicle start. The original cosigned loan would still be listed on.

Rates start at 179 for boat loans with terms up to 180 months. Cosigner and coborrower applications accepted. Note that borrowers can add a cosigner or a co-borrower to either meet eligibility requirements or qualify for lower interest rates.

Note that if you fail to pay back your loan your co-signer will be on the hook for your payments. Ad Search Navy Federal Vehicle Loan. Get Results from 6 Engines at Once.

Ad Search Navy Federal Vehicle Loan. I was listed as the primary with the same cosigner and got approved at 8000 at 1275. If you have credit problems or no established credit at all adding a joint applicant with a better.

Not only do Navy Federal borrowers have the option to add a cosigner but the credit union allows cosigners apply for release after only 12 months of consecutive on-time payments. Loans for a motorcycle loans start at 725 APR with terms up to 84 months. Navy Federal Student loans are available to students of some schools.

APRs annual percentage rates start at 179 for terms up to 96 months. In addition to car loans Navy Federal Credit Union offers financing for a wide variety of other types of vehicles.

Refinance Loans Navy Federal Credit Union

Navy Federal Credit Union Personal Loan Review Long Terms And Large Loans For Members Valuepenguin

Navy Federal Credit Union Review Military Benefits

Navy Federal Credit Union Review Military Benefits

The Ins And Outs Of Co Signing A Loan Navy Federal Credit Union

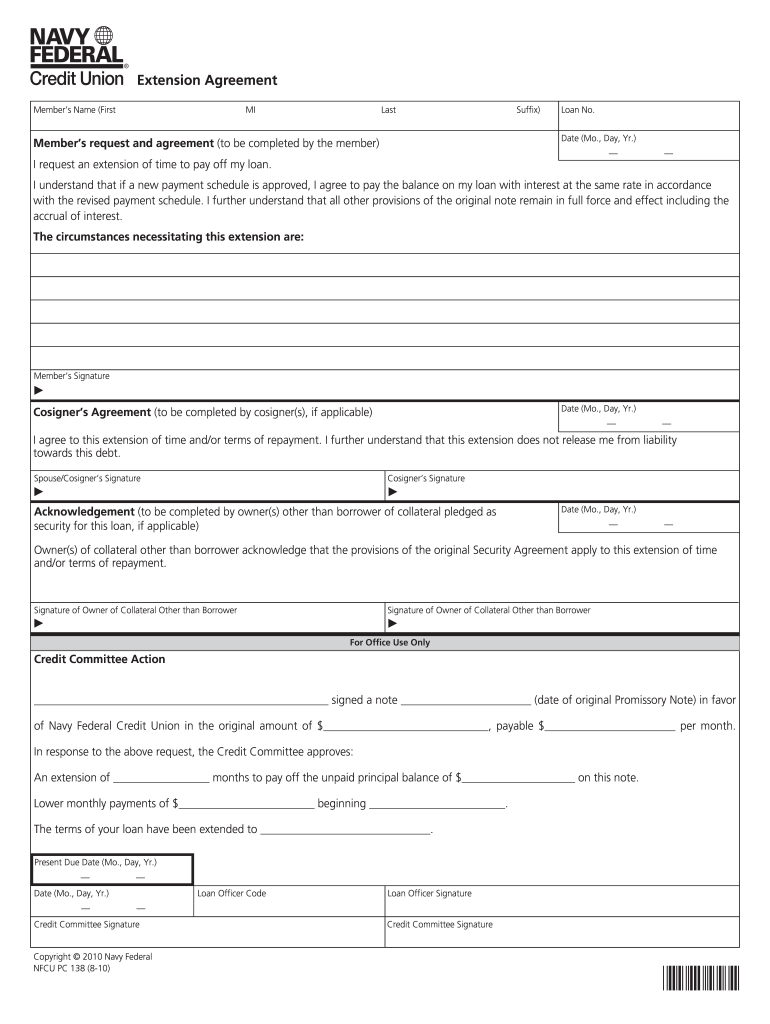

Navy Federal Payment Extension Fill Online Printable Fillable Blank Pdffiller

Navy Federal Payment Extension Fill Online Printable Fillable Blank Pdffiller

Applying For An Auto Loan Navy Federal Credit Union

Car Repossession How It Works Car Finance Car Payment Car

Car Repossession How It Works Car Finance Car Payment Car

Navy Federal Credit Union Auto Loan Review Lendedu

Navy Federal Credit Union Auto Loan Review Lendedu

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Navy Federal Credit Union Nfcu Student Loans Review

Navy Federal Credit Union Nfcu Student Loans Review

/navy-federal-credit-union_3x1-4c68213af13b44be8ccc01ff5814e55c.jpg) Navy Federal Credit Union Student Loans Review 2021

Navy Federal Credit Union Student Loans Review 2021

/navy-federal-inv-830702ddafe4476e894c3411b2046120.png) Navy Federal Credit Union Student Loans Review 2021

Navy Federal Credit Union Student Loans Review 2021

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

How Much Car Can You Afford Calculate What May Work Car Finance Car Loans Car Purchase

How Much Car Can You Afford Calculate What May Work Car Finance Car Loans Car Purchase

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Consolidate Credit Card Debt

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Consolidate Credit Card Debt

Post a Comment for "Navy Federal Auto Loan Cosigner"