What Credit Score Does Navy Federal Require For Auto Loans

With bad credit the rate will be higher. Applicants with a credit score of at least 650 and up to 850 may be eligible for Navy Federal Credit Union Auto Loan.

Creditunions Smcwin Navyfederal Federal Loans Navy Federal Credit Union Federal Student Loans

Creditunions Smcwin Navyfederal Federal Loans Navy Federal Credit Union Federal Student Loans

Unfortunately third-party sources dont seem to have much information on the credit score needed either.

What credit score does navy federal require for auto loans. How to apply for a Navy Federal auto loan. There are no additional fees associated with a Navy Federal auto loan. New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572.

There is no officially disclosed Navy Federal personal loan credit score requirement. Without putting up collateral you can borrow up to 25000 though loans up to 25000 are available if you back your loan with equipment or other. In comparison 60-month loans at Navy Federal are available with rates from 179559.

Navy Federal Credit Union Auto Loan does not have or does not disclose a. Navy Federal classifies cars made in the current and previous calendar years with less than 7499 miles as new. Navy Federal has no minimum credit score requirement.

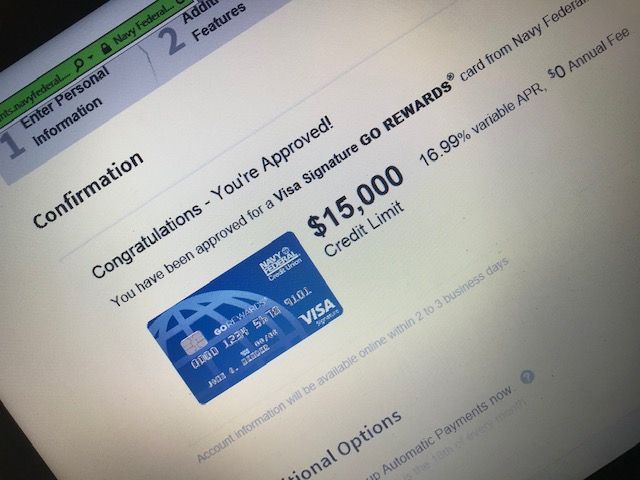

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate. However your application will be subject to other eligibility criteria and if approved your interest rate will depend on your corresponding credit score range. What score model does navy federal use.

New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572. Available nationwide Navy Federal Credit Union offers its members competitive rates especially for fair-credit borrowers given the low minimum credit score requirement and minimal fees no. Your loan term also affects the rates youre eligible for.

I filled out an auto refinance app last night -- and had an approval at the lowest APR available for my vehicle 389-- within an hour and a half. Im not 1000 sure but I believe it was EQ9. Navy Federal Credit Union Auto Loan does not have or does not disclose a.

FICO also provides credit scoring models that are specific to the auto industry giving lenders more specific information on your likelihood of paying back a car loan on time. Rates subject to change and are based on creditworthiness so your rate may differ. FICO Auto Scores.

That said Navy Federal will definitely look at your. 2020 2021 and 2022 model years with 7499 miles or less. Your APR includes an origination fee that varies based on the amount you borrow.

Rates are based on your credit having a FICO Score over 700 helps and as mentioned earlier the year model of the car youre looking to finance. You may use Navy Federal auto loans to buy from dealerships and private parties. Once youve applied to be a member you can apply for an auto loan.

Apart from membership Navy Federal Credit Union doesnt specify any requirements like minimum credit scores. Its possible to apply online in person or by calling 888-842-6328. How it works.

If you are referring to the Navy Federal Credit Union auto loans they may consider borrowers with a credit score of 300. Not everyone can qualify for a 749 APR on a 50000 loan. Rates on Navy Federal Credit Unions unsecured term loans run as high as 18 APR with terms up to five years.

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate. Applicants with a credit score of at least 650 and up to 850 may be eligible for Navy Federal Credit Union Auto Loan. A credit score of 600 or lower may result in a much higher interest rate.

It was an easy loan approval and I will recommend navy federal to anyone. 2020 2021 and 2022 model years with 7499 miles or less. The minimum age to be eligible is 18 or the state minimum whichever is higher.

Rates subject to change and are based on creditworthiness so your rate may differ. In general it means that although different lenders use different measures people with exceptional credit scores may qualify for the lowest rates while people with lower credit scores will often qualify only for loans with higher rates. It does note that you can still get a loan if you have limited credit history though you may need a co-applicant depending on the amount you want to borrow.

The industry standard for a 60-month auto loan for someone with near-perfect credit is around 360. In general it means that although different lenders use different measures people with exceptional credit scores may qualify for the lowest rates while people with lower credit scores will often qualify only for loans with higher rates. You typically need to have a credit score of around 760 or higher and enough cashflow to support repayments for the lowest rates and highest amounts a lender offers.

The minimum age to be eligible is 18 or the state minimum whichever is higher. My credit was not good since I never knew about credit until I loaned a car and didnt realize navy federal just approved my auto loan with no hesitation or kept me waiting. A credit score of 700 or higher will generally get you a lower interest rate on your loan.

Instead it uses a holistic approach to determine members creditworthiness according to a spokesperson. How to apply for a Navy Federal auto loan. Before a lender loans you money they want to make sure youll be able to repay the loan.

Minimum loan amount is 30000 for terms of 85-96 months. If a lender uses this score during the underwriting process any past payment issues youve had with auto loans could make it more difficult to get approved. Minimum loan amount is 30000 for terms of 85-96 months.

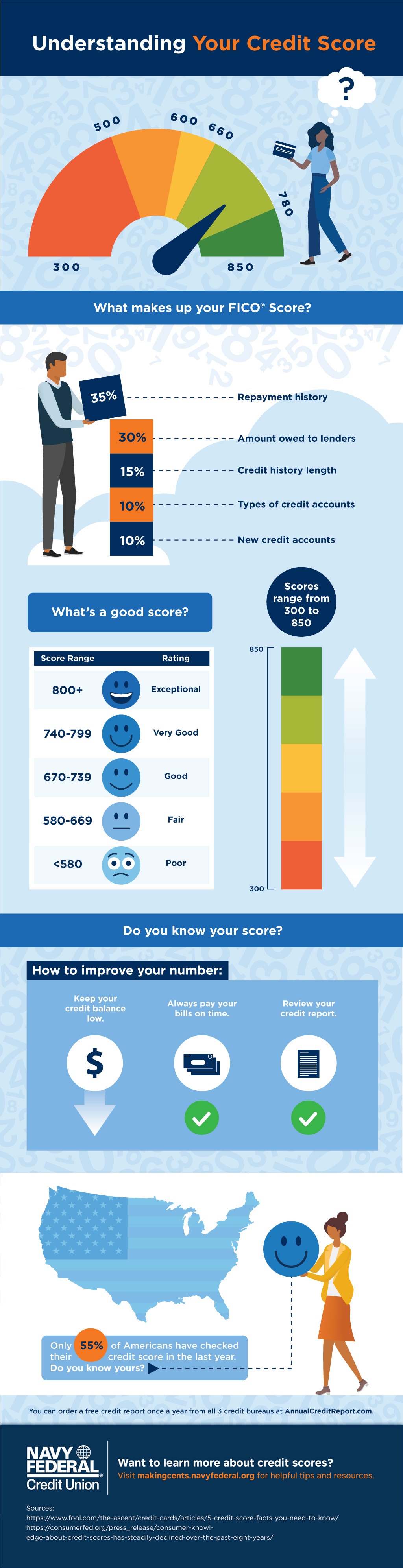

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

Pin On Consumer Lending Forms For Credit Unions

Pin On Consumer Lending Forms For Credit Unions

It Is Easy Today To Look For A Store Credit Card That You Forget Everything About In Three Years However That A Credit Union Forms Credit Union Credit Repair

It Is Easy Today To Look For A Store Credit Card That You Forget Everything About In Three Years However That A Credit Union Forms Credit Union Credit Repair

Navy Federal Credit Union Auto Loans Review

Navy Federal Credit Union Auto Loans Review

Navy Federal Credit Union Helped A Man Who Trains Dogs For The Marines Buy A New Truck With Its Fas Navy Federal Credit Union Federal Credit Union Credit Union

Navy Federal Credit Union Helped A Man Who Trains Dogs For The Marines Buy A New Truck With Its Fas Navy Federal Credit Union Federal Credit Union Credit Union

Navy Federal Auto Loans Review Limited Availability Credit Karma

Navy Federal Auto Loans Review Limited Availability Credit Karma

Navy Federal Credit Union Mortgage Review 2021 Us News

Navy Federal Credit Union Mortgage Review 2021 Us News

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Refinance Your Car Loan Through Navy Federal Credit Union Learn More About How Navy Federal Refinancing Progra In 2021 Debt Advice Improve Credit Score Improve Credit

Refinance Your Car Loan Through Navy Federal Credit Union Learn More About How Navy Federal Refinancing Progra In 2021 Debt Advice Improve Credit Score Improve Credit

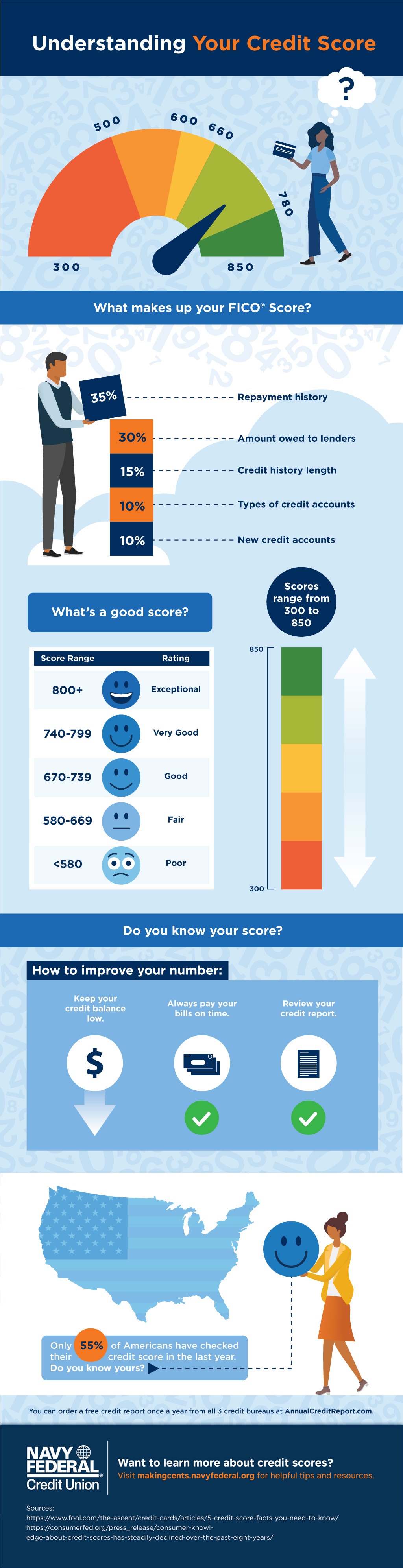

Approved For 25 000 Navy Federal Visa Credit Card W 564 Fico Credit Score Youtube

Approved For 25 000 Navy Federal Visa Credit Card W 564 Fico Credit Score Youtube

Credit Cards Military Credit Cards Navy Federal Credit Union

/navy-federal-credit-union_3x1-4c68213af13b44be8ccc01ff5814e55c.jpg) Navy Federal Credit Union Student Loans Review 2021

Navy Federal Credit Union Student Loans Review 2021

See My New Video I Made Today How To Get Credit Karma Credit Card Limit

See My New Video I Made Today How To Get Credit Karma Credit Card Limit

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Consolidate Credit Card Debt

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Consolidate Credit Card Debt

The Servicemember S Guide To Car Buying Navy Federal Credit Union Car Buying Navy Federal Credit Union Federal Credit Union

The Servicemember S Guide To Car Buying Navy Federal Credit Union Car Buying Navy Federal Credit Union Federal Credit Union

A Navy Federal Credit Union Transunion Credit Score Algorithm For Credit Card Approvals Youtube

A Navy Federal Credit Union Transunion Credit Score Algorithm For Credit Card Approvals Youtube

10 000 Navy Federal Cash Rewards Visa Credit Card Review Https Www Youtube Com Watch V Otewfhkvg I Credit Card Transfer Credit Card Platinum Credit Card

10 000 Navy Federal Cash Rewards Visa Credit Card Review Https Www Youtube Com Watch V Otewfhkvg I Credit Card Transfer Credit Card Platinum Credit Card

Auto Loan Refinancing Refinance Your Car Loan Navy Federal Credit Union

Auto Loan Refinancing Refinance Your Car Loan Navy Federal Credit Union

Post a Comment for "What Credit Score Does Navy Federal Require For Auto Loans"