Dell Lbo Financing Structure

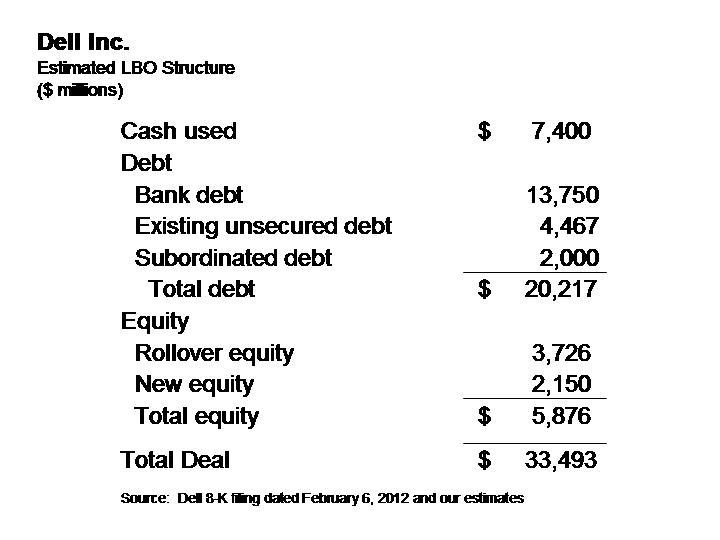

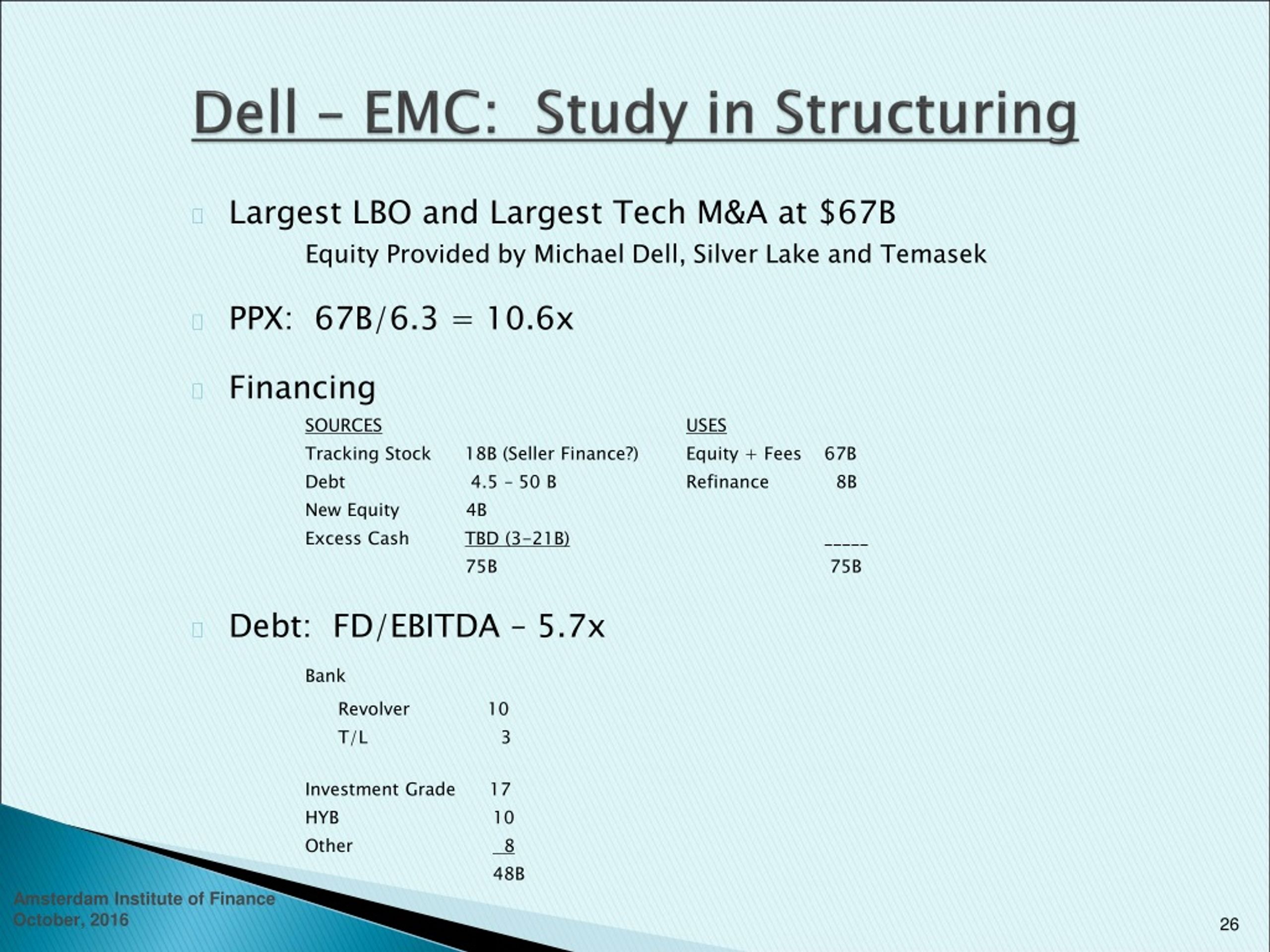

Usually takes up a small part of the LBO capital structure around 5 and is often financed by hedge funds and specialized PE funds. By the end of the financing campaign Dell and Silver Lake fashioned a capital structure where the combined company generates about 7 billion in annual earnings before interest depreciation.

A Closer Look At The Dell Lbo Private Dell Old Seeking Alpha

A Closer Look At The Dell Lbo Private Dell Old Seeking Alpha

Leveraged loan in LBO financing structure as well as allowed to get new debt to develop fleet of trucks and increase turnover.

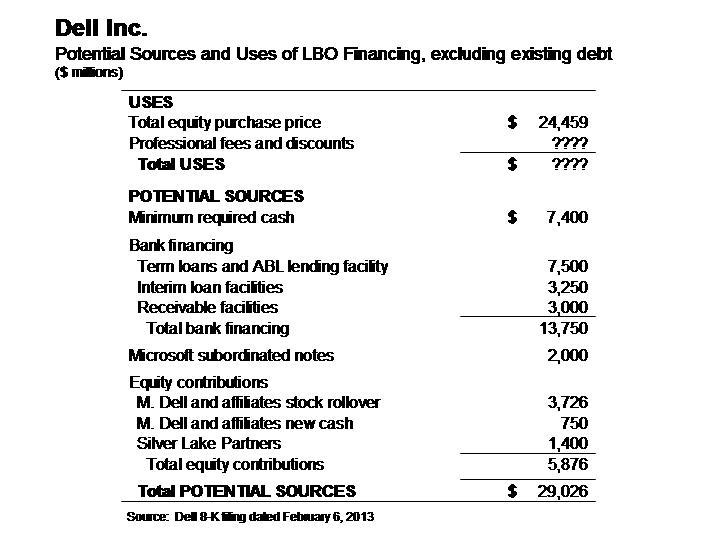

Dell lbo financing structure. When proposing an MBO a financial sponsor determines whether and how much to bid by using an LBO model which solves for the range of prices that a financial. The more confusing the scenario the better it is for a case study right. Michael Dell in partnership with private equity fund Silver Lake Partners and with financing from Microsoft and four banks is proposing a 23 billion buyout of the computer company.

The Five Simple Steps of LBO Analysis nStep 1. 28 Step 1 Understand. The pro forma capitalization and transaction structure are.

Also known as bank debt it refers to a substantial source of capital especially in leveraged buyout LBO transactions. Construct Sources Uses nStep 3. The Michael Dell-led LBO structure puts a major onus for producing Dell growth on equity stakeholders who are not in the deal for near-term pay-back and can afford to stay in the position long.

Run the IRRs nStep 4. Mezzanine debt or hybrid debt. Its a 25 billion deal give or take after including fees.

A debt of 75 billion has been issued which is the second-largest institutional LBO loan this year behind Heinzs 95 billion institutional issuance for Heinzs 28 billion buyout by Berkshire Hathaway and 3G Capital. In the first SBO of its 3 Fraikin SA funded 600 million euro. Create revenue and expense scenarios.

In other words corporate debt is a method of financing a transaction in which a company receives a loan that is usually issued within the private market community. Set up the model and the assumptions and gather data for everything. Heres the PDF that lays out exactly what were going to cover in this leveraged buyout case study.

Multiple tranches of debt are commonly used to finance LBOs and may including any of the following tranches of capital listed in descending order of seniority. The timing is good because a bunch of factors have changed since the last time we looked at this deal and its unclear who will win or if anyone will actually end up acquiring the company. According to one banker close to the deal Dell will raise a total of 45 billion in debt to do the deal slightly lower than has so far been reported.

More information LBO Model - Overview Capital-Structure Dell Case Study. What are the risks. Offer was withdrawn due to DELLs deteriorating business.

Lets estimate the company has 35 billion of onshore cash and LT investments available to use in the transaction which counts. What is the real EBITDA. Consult the leveraged finance group at an investment bank for current parameters.

The deal will be financed with cash and equity from Michael Dell 1 billion cash from private equity firm Silver Lake a 2 billion loan from Microsoft Corp and between 11 billion. Sources Uses. It is a method of obtaining funding without offering collateral.

Evaluate the Story Is this a good debt story. Oct 19 2013 - In this LBO Model tutorial we walk through Silver Lakes 24 billion leveraged buyout of Dell and explain the tasks you might have to complete if you were t. It requires a higher interest rate compared to senior debt as it involves a higher level of risk.

Does the LBO work. Only about 10 billion of that though will. At long last we pick up today with Part 2 of this case study on the Dell leveraged buyout announced in February.

In a leveraged buyout LBO the target companys existing debt is usually refinanced although it can be rolled over and replaced with new debt to finance the transaction. Thus it is not controlled by SEC regulations or any disclosure requirements. Capital structure in a Leveraged Buyout LBO refers to the components of financing that are used in purchasing a target company.

Also the financing limit will depend on the circumstances specific to the transaction and the growth potential of the target. Although each LBO is structured differently the capital structure is almost similar in most newly-purchased companies with the largest percentage of LBO financing.

Importance Of Leveraged Buyout Edupristine

Importance Of Leveraged Buyout Edupristine

A Closer Look At The Dell Lbo Private Dell Old Seeking Alpha

A Closer Look At The Dell Lbo Private Dell Old Seeking Alpha

Hilton Leveraged Buyout The Hospitality Buyout Of The Century Youtube

Hilton Leveraged Buyout The Hospitality Buyout Of The Century Youtube

Ppt Acquisition Finance Structuring Structuring The Deal Powerpoint Presentation Id 171686

Ppt Acquisition Finance Structuring Structuring The Deal Powerpoint Presentation Id 171686

Leveraged Buyout Lbo Definition Example Business Promotion

Leveraged Buyout Lbo Definition Example Business Promotion

Lbo Capital Structure Page 7 Line 17qq Com

Lbo Capital Structure Page 7 Line 17qq Com

Leveraged Buyout Lbo Definition Example Business Promotion

Leveraged Buyout Lbo Definition Example Business Promotion

Lbo Capital Structure Page 7 Line 17qq Com

Lbo Capital Structure Page 7 Line 17qq Com

Dell S Leveraged Buyout A Real Life Case Study Edupristine

Dell S Leveraged Buyout A Real Life Case Study Edupristine

Lbo Model Tutorial Full Dell Case Study With Templates Part 1 Youtube

Lbo Model Tutorial Full Dell Case Study With Templates Part 1 Youtube

Ppt Acquisition Finance Structuring Structuring The Deal Powerpoint Presentation Id 171686

Ppt Acquisition Finance Structuring Structuring The Deal Powerpoint Presentation Id 171686

Financing Acquisitions Top 7 Methods With Business Examples

Financing Acquisitions Top 7 Methods With Business Examples

Dell Is Going Private Case Study 1 2 Why Dell Going Private Major Reasons Autonomy Leadership Strategy Customers Shareholders Ppt Download

Dell Is Going Private Case Study 1 2 Why Dell Going Private Major Reasons Autonomy Leadership Strategy Customers Shareholders Ppt Download

Post a Comment for "Dell Lbo Financing Structure"