What Credit Score Does Navy Federal Use For Auto Loans

Late Model Used Vehicles. How it works.

It Is Easy Today To Look For A Store Credit Card That You Forget Everything About In Three Years However That A Credit Union Forms Credit Union Credit Repair

It Is Easy Today To Look For A Store Credit Card That You Forget Everything About In Three Years However That A Credit Union Forms Credit Union Credit Repair

2020 2021 and 2022 model years with 7499 miles or less.

What credit score does navy federal use for auto loans. 2019 and older model years or any model year with over 30000 miles. To score the rate discount you must have direct deposit and contact the credit. You may use Navy Federal auto loans to buy from dealerships and private parties.

What influences your auto loans interest rate the most is your credit score. Rates are based on your credit having a FICO Score over 700 helps and as mentioned earlier the year model of the car youre looking to finance. If you are referring to the Navy Federal Credit Union auto loans they may consider borrowers with a credit score of 300.

If a lender uses this score during the underwriting process any past payment issues youve had with auto loans could make it more difficult to get approved. Thats important because late model cars qualify for the same low APR as new cars which is currently 199 percent. You cant check your rates or see if you prequalify for Navy Federal Credit Union Auto Loan without a hard pull on your credit report.

Although FICO didnt create these models specifically for auto lenders they are widely used credit scores and auto lenders may use a base FICO Score when reviewing auto loan applications. Rebuilt it With The Right Loan. Rebuilt it With The Right Loan.

March 2018 - EX. Late Model Used Vehicles. As of Dec.

Minimum loan amount is 30000 for terms of 85-96 months. What your credit score number means and how its categorized depends on the credit bureau issuing it. The minimum age to be eligible is 18 or the state minimum whichever is higher.

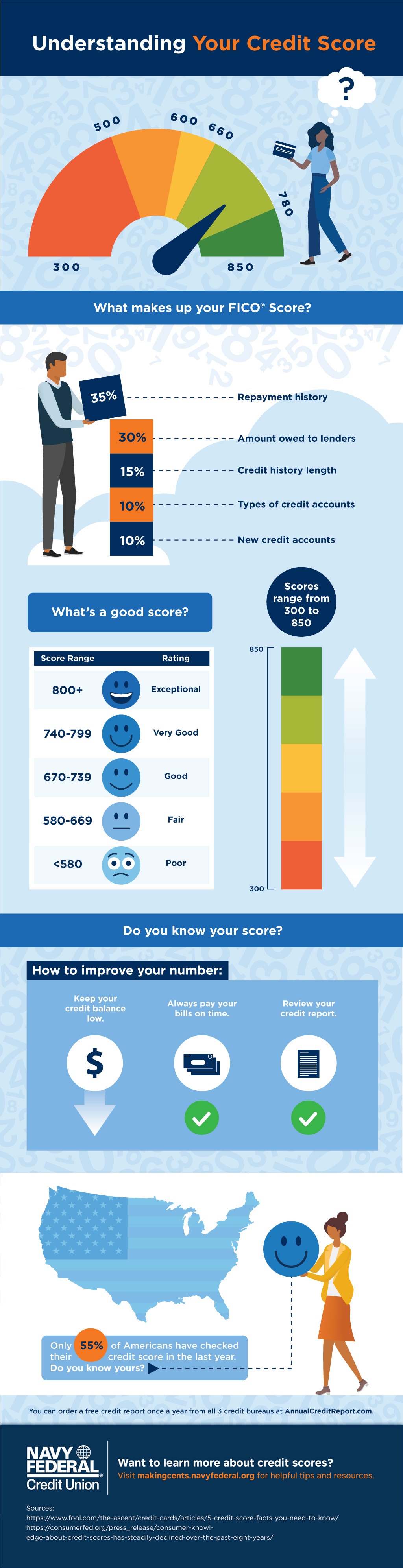

Find Good Loans For Bad Credit. My FICO 8 is a lot higher than the auto score models. Five factors are used to determine your credit score.

There are no additional fees associated with a Navy Federal auto loan. Your loan term also affects the rates youre eligible for. Navy Federal Credit Union Late Model and Late Model Used Auto Loans If the vehicle you want to buy is a 2015 2016 or 2017 model with a mileage count of 7500 to 30000 NFCU considers it a late model car.

Find Good Loans For Bad Credit. Experian for example rates scores using two types of credit scores commonly used by lenders. FICO Auto Scores.

The industry standard for a 60-month auto loan for someone with near-perfect credit is around 360. The single greatest factor that influences your auto loans interest rate is your credit score. 509 March 2019 - EX.

Navy Federal Classic auto loans have a starting APR of 809 and a maximum term of 180 months. 423 February 2019 - EX. Payment history usually around 35 percent of your score amount owed 30 percent length of credit history 15 percent newly opened credit accounts 10 percent and types of credit used 10 percent.

Although not all credit scores are calculated in exactly the same way they do follow similar rules. Navy Federal Credit Union Auto Loan does not have or does not disclose a. There are multiple versions of the industry-specific FICO Auto Score which is created specifically for auto lenders.

However your application will be subject to other eligibility criteria and if approved your interest rate will depend on your corresponding credit score range. In comparison 60-month loans at Navy Federal are available with rates from 179559. Borrowers with a credit score as low as 650 may qualify for Navy Federal Credit Union Auto Loan.

2020 2021 and 2022 model years with 7500-30000 miles. New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572. In general some of the factors that make up your score include your payment history how much you still owe the type of debt you have and how long youve had it and other factors.

FICO also provides credit scoring models that are specific to the auto industry giving lenders more specific information on your likelihood of paying back a car loan on time. Not everyone can qualify for a 749 APR on a 50000 loan. Applicants with a credit score of at least 650 and up to 850 may be eligible for Navy Federal Credit Union Auto Loan.

Navy Federal offers competitive interest rates on auto loans and active duty and retired military members may qualify for an interest rate discount. FICO Auto Scores. The credit score needed for Navy Federal Credit Union Auto Loan is relatively low.

2020 2021 and 2022 model years with 7500-30000 miles. Almost Everyone Approved - Even Bad Credit. 11 2019 Navy Federal offered 200 to those who refinanced a loan from another lender.

How to apply for a Navy Federal auto loan. You typically need to have a credit score of around 760 or higher and enough cashflow to support repayments for the lowest rates and highest amounts a lender offers. Almost Everyone Approved - Even Bad Credit.

Competitive auto loan rates and rate discounts. Hard credit pull required. Navy Federal doesnt refinance its own loans.

With bad credit the rate will be higher. These five categories may be weighted differently depending on your individual circumstances. New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572.

Navy Federal classifies cars made in the current and previous calendar years with less than 7499 miles as new.

Pin On Consumer Lending Forms For Credit Unions

Pin On Consumer Lending Forms For Credit Unions

Navy Federal Auto Loans Review Limited Availability Credit Karma

Navy Federal Auto Loans Review Limited Availability Credit Karma

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Consolidate Credit Card Debt

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Consolidate Credit Card Debt

The Servicemember S Guide To Car Buying Navy Federal Credit Union Car Buying Navy Federal Credit Union Federal Credit Union

The Servicemember S Guide To Car Buying Navy Federal Credit Union Car Buying Navy Federal Credit Union Federal Credit Union

Should You Open A Navy Federal Credit Union Business Account

Should You Open A Navy Federal Credit Union Business Account

Navy Federal Credit Union Personal Loans Review 2021 Finder Com

Navy Federal Credit Union Personal Loans Review 2021 Finder Com

Navy Federal Credit Union Personal Loans Review 2021

Navy Federal Credit Union Personal Loans Review 2021

Top 10 Mortgage Companies That Specialize In Bad Credit 2021 Navy Federal Credit Union Federal Credit Union Credit Union

Top 10 Mortgage Companies That Specialize In Bad Credit 2021 Navy Federal Credit Union Federal Credit Union Credit Union

Auto Loan Refinancing Refinance Your Car Loan Navy Federal Credit Union

Auto Loan Refinancing Refinance Your Car Loan Navy Federal Credit Union

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Qualifying For An Auto Loan Makingcents Navy Federal Credit Union

Refinance Your Car Loan Through Navy Federal Credit Union Learn More About How Navy Federal Refinancing Progra In 2021 Debt Advice Improve Credit Score Improve Credit

Refinance Your Car Loan Through Navy Federal Credit Union Learn More About How Navy Federal Refinancing Progra In 2021 Debt Advice Improve Credit Score Improve Credit

Go Rewards Credit Card Navy Federal Credit Union

Navy Federal Credit Union Auto Loans Review

Navy Federal Credit Union Auto Loans Review

How To Buy Any Car On Any Budget Budgeting Navy Federal Credit Union Federal Credit Union

How To Buy Any Car On Any Budget Budgeting Navy Federal Credit Union Federal Credit Union

See My New Video I Made Today How To Get Credit Karma Credit Card Limit

See My New Video I Made Today How To Get Credit Karma Credit Card Limit

Consumer Lending Oak Tree Business Systems Consumer Lending Personal Loans Personal Loans Online

Consumer Lending Oak Tree Business Systems Consumer Lending Personal Loans Personal Loans Online

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

Creditunions Smcwin Navyfederal Federal Loans Navy Federal Credit Union Federal Student Loans

Creditunions Smcwin Navyfederal Federal Loans Navy Federal Credit Union Federal Student Loans

Post a Comment for "What Credit Score Does Navy Federal Use For Auto Loans"