How Does 0 Apr Financing Work

Car dealers usually offer 0 financing on new cars only and you typically need to have a very strong credit history. When it comes to credit cards 0 APR is often associated with the introductory rate you may get when you open a new account.

Best 0 Apr Financing Deals Right Now

Best 0 Apr Financing Deals Right Now

A 0 APR deal means that you can borrow money for free and 100 of every payment you make is.

How does 0 apr financing work. In order to take advantage of this offer youll need to make at least the minimum payments due on your statement. Part of your monthly car payment will go toward paying the lender and part will go toward your loan. How Does 0 APR Work.

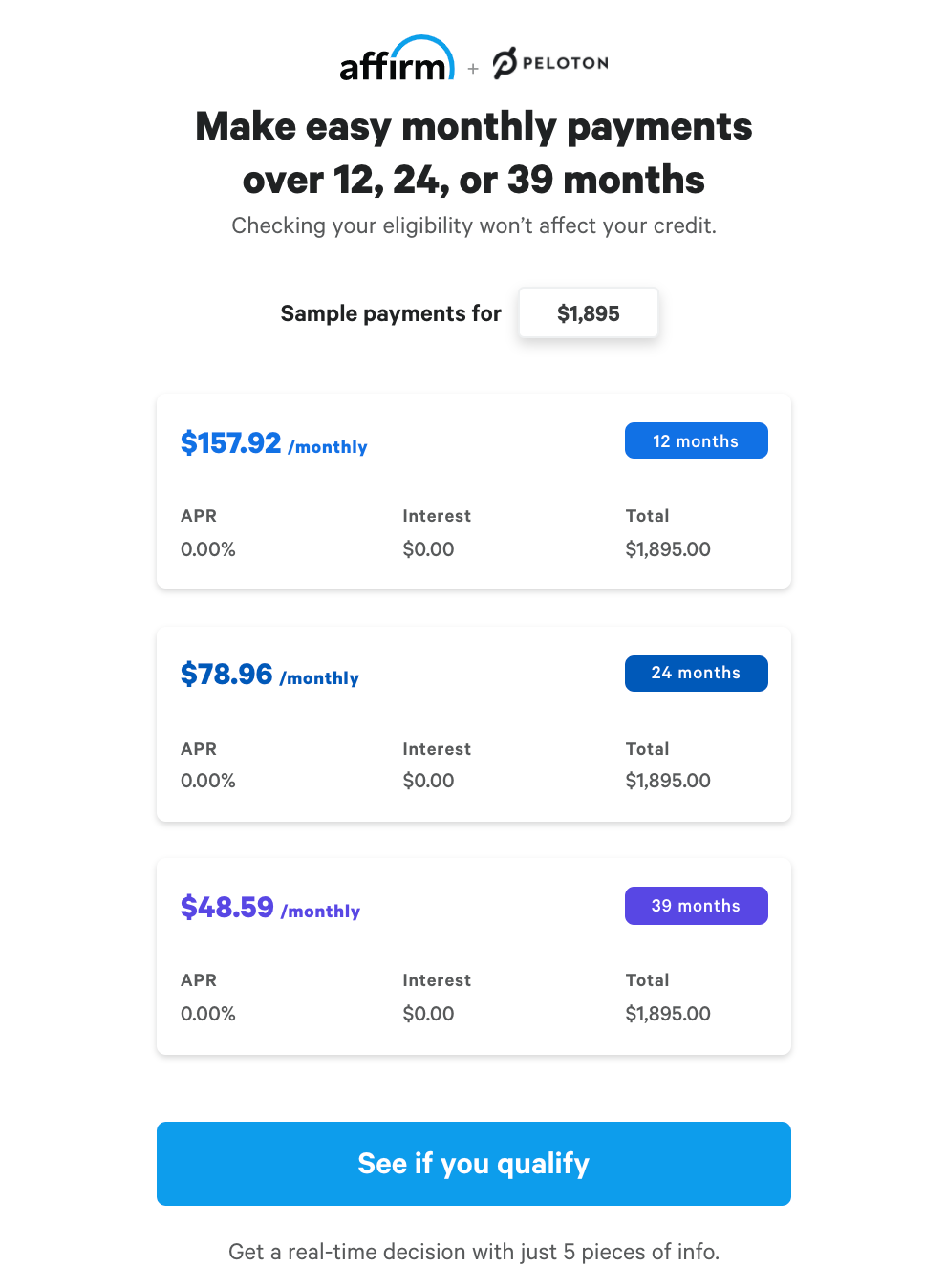

Qualification for all loans shall be determined by Affirm in. Your monthly payments reimburse the lender for the money it paid the. However the risk outweighs the reward if youve been approved for 0 financing but the vehicle cost surpasses your budget allotment.

By using a 0 APR offer to avoid costly interest charges while you pay off your balance or by avoiding interest on necessary purchases you can leverage these offers to benefit your business as much as possible. Sometimes a dealership will offer its own version of zero percent. A 0 APR means that you pay no interest on certain transactions during a certain period of time.

An annual percentage rate or APR is that yearly rate plus lender fees not dealer fees. When you see a dealership advertising zero-percent financing it means the car dealer is offering to lend you money for a new car without charging any interest fees over the life of the loan. If the dealer explains that you cant be financed at zero percent you shouldnt necessarily back out on the deal.

The good news is 0 financing is like free money for 12 months. The Edmunds Incentives and Rebates page also highlights zero percent financing offers and other promotions for the month. One type of 0 APR offer is for purchases.

Qualified customers can pay over 3 6 or 12 months with rates starting at 0 APR. A 0 introductory purchase APR means you wont be charged interest on your purchases for a certain period of time as determined by your credit card company. The 0 APR balance transfer is the best of all balance transfer promotions because it means you wont pay any interest transferred amount until after the promotional period.

How Does a 0 APR Car Loan Work. How does your 0 APR financing with Affirm work. 0 APR is available on 3-month 6-month and 12-month terms only.

The purchase APR is the interest rate that applies to things you buy with the card. Being approved for a 0 APR credit card means you wont have to pay interest on purchases charged to it for some specified amount of time. They also offer loans over 18 24 for 1300 and 36 months for 1600 at 10-30.

Zero percent APR car loans are auto loans with no interest rate. As long as the total cost of the car fits your budget and you can afford to make the monthly payments on time 0 APR financing could save you thousands of dollars in interest throughout the loan term. A 0 promotional APR may apply to a cards purchase APR or balance transfer APR or both.

Youll often find 0 APR balance transfer offers that last between 6. But there are numerous downsides that can make these offers a bust from a credit perspective. 0 APR on balance transfers A 0 APR on balance transfers is a credit card perk that lets you move debt from another account and pay it off without interest for a promotional period.

How long is the term. This means you can finance a new vehicle purchase and 100 of your monthly payment will go toward the principal balance of the loanthere are no interest charges whatsoever. Qualifying for a promotional balance transfer offer usually requires you to have good to excellent credit.

With a zero APR auto deal however you essentially borrow money for free. If you dont qualify Affirm offers 10-30 financing. The interest you pay helps the lender earn a profit.

0 APR promotional financing offers for small business credit cards can be extremely valuable but only when you use them wisely. There isnt a certain credit score thats set in stone that determines whether you qualify for zero percent financing but generally a credit score of around 740 or higher is considered very good. Pay over 3 6 or 12 months with rates as low as 0 APR for qualifying purchases.

A 0 APR for purchases gives you the ability to buy something with your card and then pay it off over time. Most 0 APR credit cards offer this promotion for between 12 and 15 months but some extend the deal as long as 18 or 21 months.

Best 0 Apr Credit Cards Of 2021 No Interest For Up To 20 Months

Best 0 Apr Credit Cards Of 2021 No Interest For Up To 20 Months

Best 0 Apr Financing Deals Right Now

Best 0 Apr Financing Deals Right Now

Buy Now Pay Later Vs Pos Lending A Crash Course

Buy Now Pay Later Vs Pos Lending A Crash Course

0 Apr Car Deals In 2021 What S The Catch Lendingtree

0 Apr Car Deals In 2021 What S The Catch Lendingtree

Screenshot Elegant Themes Car Dealer Layout

Screenshot Elegant Themes Car Dealer Layout

A Hot Button Topic This Year Is Predatory Lending This Is Specifically Relevant To Lending Groups That Offer Fast Cash Loans This Includes Crous Aide Sociale

A Hot Button Topic This Year Is Predatory Lending This Is Specifically Relevant To Lending Groups That Offer Fast Cash Loans This Includes Crous Aide Sociale

How To Finance A Car At 0 Interest Nerdwallet

How To Finance A Car At 0 Interest Nerdwallet

How Do 0 Apr Credit Cards Work Everything You Should Know Valuepenguin

Annual Percentage Rate Apr And Effective Apr Video Khan Academy

Annual Percentage Rate Apr And Effective Apr Video Khan Academy

Best 0 Apr Financing Deals Right Now

Best 0 Apr Financing Deals Right Now

What S The Catch With Zero Percent Car Loans Autotrader

What S The Catch With Zero Percent Car Loans Autotrader

Best 0 Apr Financing Deals Right Now

Best 0 Apr Financing Deals Right Now

What Is A 0 Apr Credit Card Forbes Advisor

What Is A 0 Apr Credit Card Forbes Advisor

Is 0 Apr Financing Free Money Personal Finance Blogs Free Money Finance Apps

Is 0 Apr Financing Free Money Personal Finance Blogs Free Money Finance Apps

Post a Comment for "How Does 0 Apr Financing Work"