Navy Federal Auto Loan To Value Ratio

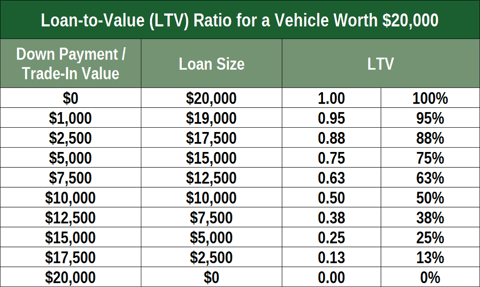

For example if a borrower takes a 75000 loan to buy a 100000 property the LTV would be expressed as 75000 to 100000 75000100000 or 75. Click to see full answer.

Form 12 Filled Out Form 12 Filled Out Will Be A Thing Of The Past And Here S Why Irs Taxes Tax Return Income Tax Return

Form 12 Filled Out Form 12 Filled Out Will Be A Thing Of The Past And Here S Why Irs Taxes Tax Return Income Tax Return

While extended loan terms of up to 144 months are possible traditional auto loan terms 48 to 84 months are still the norm.

Navy federal auto loan to value ratio. However many circumstances can lead to the value of the car not matching up to the amount you still owe on your loan. To cover these potential losses it had 14629544939 in net worth and 2620568613 in loans loss reserves. Moreover will Navy Federal sell my mortgage.

Fortunately I wasnt AUTO-DECLINED but it wasnt approved either. Minimum loan amount is 30000 for terms of 85-96 months. 2020 2021 and 2022 model years with 7500-30000 miles.

Check out our auto loan options. In many cases the lender will pay most or all of the closing costs of the home equity loan such as the application fee documentation fees appraisal fee title fee and other assorted fees. Navy Federal can provide loans for up to 500000 depending upon the circumstances.

It has to go to a comittee for approval. Navy Federal offers competitive rates and flexible terms. Their loan-to-value ratios range from 70 to 100 in some instances.

The Military Choice mortgage for active-duty military members and veterans offers financing up to 100 a fixed rate terms of 16 to 30 years and no private mortgage insurance PMI. Navy Federal Credit Union has very flexible standards for mortgage refinancing allowing borrowers to refinance at loan-to-value ratios as high as 97 percent. These borrowers will need to exceed their residual income guidelines by 20 percent to satisfy the VA and lenders.

She said based on my credit if approved my interest rate would be 12 which is bananas considering my credit score. The vehicle may depreciate or perhaps you need additional money to pay for negative equity or debt on a previous car loan. The borrower gets the loan as a lump sum amount and repays it back to the lender over a fixed period and interest rates.

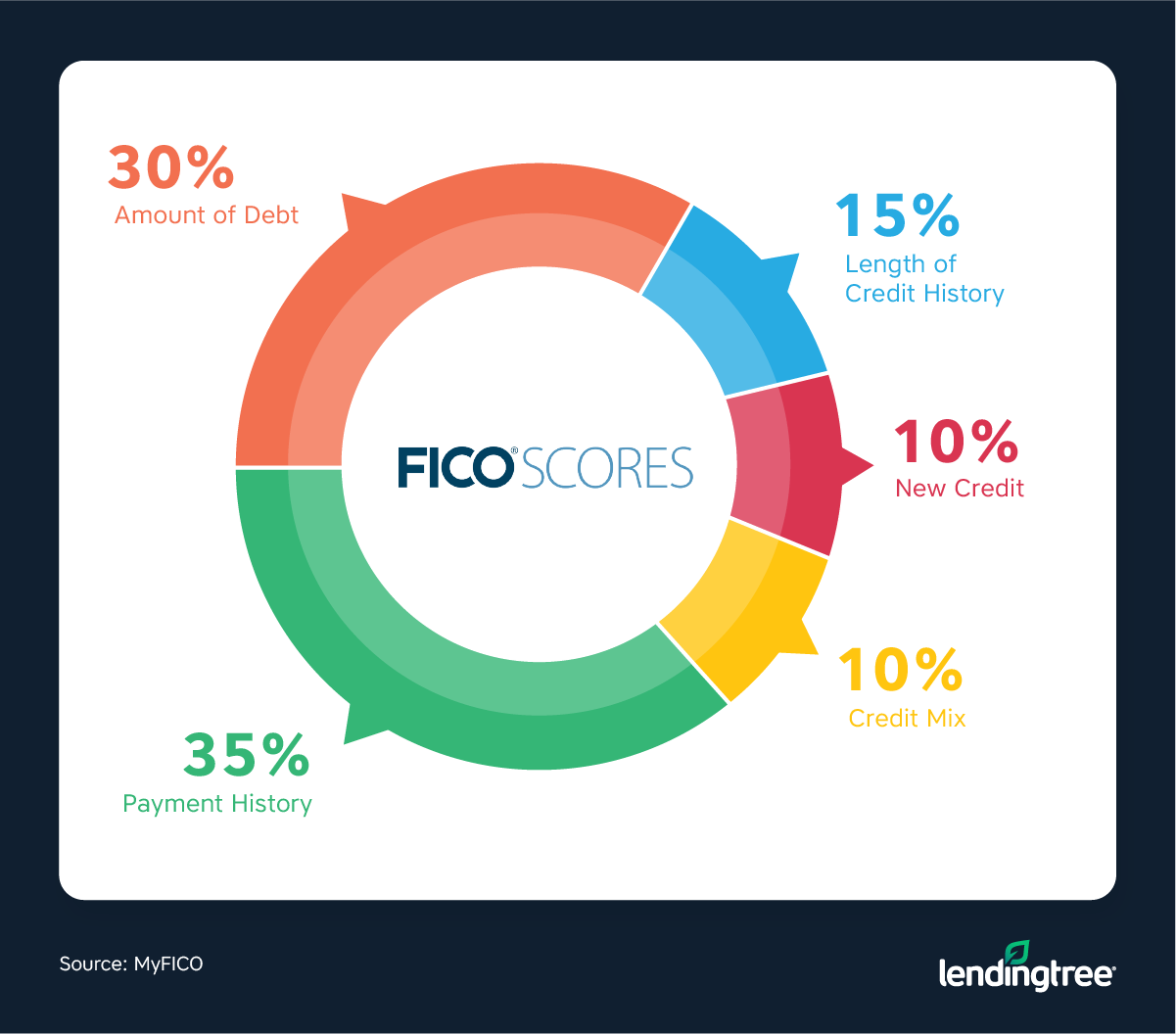

According to BankRate Navy Federal requires a 620 credit score to qualify for a home loan but againthose compensating factors matter. For example if you want a 90000 exotic car loan lenders like to see that you had a previous auto loan of 60000. New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572.

In the case of auto loans insurance is generally the car itself. In some case the fees can be included TTL doc fee warranty etc. Navy Federal HomeBuyers Choice DTI Requirements Because my husband and I paid off 63000 in debt last year our debt to income ratio is very low but I couldnt get a clear answer from Navy Federal on this.

I just applied for a Navy Federal auto loan for about 12000 on a new car i have about 7000 to put down. Navy Federal Credit Union has very flexible standards for mortgage refinancing allowing borrowers to refinance at loan-to-value ratios as high as 97 percent. Loan to Value AutoCar Loan On a car loan many lenders will loan up to 125 of the LTV ratio which is absurd.

Loan-to-value ratio is a term used by lenders to represent the amount of a loan compared to the value of the property securing the loan. 2020 2021 and 2022 model years with 7499 miles or less. Ask you bank what their approval specifics are.

The upfront amount contributed to the purchase price of an item bought on credit. This is exactly how many so people get upside down on car loans owing more than a. Your actual annual percentage rate APR will be based on your specific situation.

Combined Loan-to-Value Ratio CLTV. Also ask what the loan to value ratio is. They arent going to hand you the extra in cash or make you pay for it.

To protect borrowers from unusually high LIBOR rates Navy Federal Credit Union caps its variable rates at 18. 2020 2021 and 2022 model years with 7500-30000 miles. You may get a more favorable rate if you contribute some money upfront toward a vehicles purchase price.

Late Model Used Vehicles. The industry standard for a 60-month auto loan for someone with near-perfect credit is around 360. The average interest rate today is 6 and the period can range between 5 and 15 years and the lender makes sure that the 80 loan-to-value ratio is not.

If our example Midwestern family of four has a DTI ratio above 41 percent heres what their residual income requirement would look like. In comparison 60-month loans at Navy Federal are available with rates from 179559. Home equity loans operate almost like an auto loan or a mortgage.

Navy Federal offers several types of mortgage loans for purchasing a home and jumbo loans for amounts larger than 484350. New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572. They can be as low as five percent of the vehicles purchase price.

2020 2021 and 2022 model years with 7499 miles or less. Overall the new car auto loan rates at Navy Federal are some of the most attractive across the industry including what youll find at online banks. My credit score is 582.

You take a loan for the amount of the car nothing more. Late Model Used Vehicles. Down payments on cars can vary.

There are never any hidden fees with Navy Federal Credit Union and they never sell the loan to another bank. If you buy a 5000 car you finance 5000. As of December 31 2020 Navy Federal Credit Union had 439949634 in non-current loans and 19208272 in owned assets.

Variable rates work by giving borrowers a rate that Navy Federal Credit Union calculates and adds to the three-month LIBOR. NFCU also participates in the Home Affordable Refinance Program a federal initiative that enables qualified homeowners to refinance their mortgage even if they are underwater on the loan. Minimum loan amount is 30000 for terms of 85-96 months.

Our advertised rates offered are subject to change at any time and depend on the individuals credit in addition to vehicle characteristics.

Real Estate Title Date Common App Finance Finance Plan Khan Academy

Real Estate Title Date Common App Finance Finance Plan Khan Academy

25 Cover Letter Builder Business Letter Format Executive Resume Template Resume Template Word

25 Cover Letter Builder Business Letter Format Executive Resume Template Resume Template Word

Texas Cash Out Refinance Investment Property Cash Out Refinance Refinance Loans Refinancing Mortgage

Texas Cash Out Refinance Investment Property Cash Out Refinance Refinance Loans Refinancing Mortgage

What Is Home Equity Navy Federal Credit Union

Applying For A Home Equity Loan Navy Federal Credit Union

Nris Can Get Car Loans In India But Conditions Apply

Nris Can Get Car Loans In India But Conditions Apply

The Mortgage Refinance Process Navy Federal Credit Union

Mortgage Terms To Understand Homebuyer Guide Financial Wellness Credit Union

Mortgage Terms To Understand Homebuyer Guide Financial Wellness Credit Union

Applying For A Home Equity Loan Navy Federal Credit Union

Taxes Can Be A Dream Not A Nightmare Types Of Dreams Dream Make More Money

Taxes Can Be A Dream Not A Nightmare Types Of Dreams Dream Make More Money

Applying For A Home Equity Loan Navy Federal Credit Union

Applying For A Home Equity Loan Navy Federal Credit Union

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

Combining Auto Loans Consolidate Car Loans Lendingtree

Combining Auto Loans Consolidate Car Loans Lendingtree

6 Best Mortgage Refinance Companies Of April 2021 Money

6 Best Mortgage Refinance Companies Of April 2021 Money

Applying For A Home Equity Loan Navy Federal Credit Union

5 Best Bad Credit Auto Refinance Loans 2021 Badcredit Org

5 Best Bad Credit Auto Refinance Loans 2021 Badcredit Org

Applying For A Home Equity Loan Navy Federal Credit Union

Post a Comment for "Navy Federal Auto Loan To Value Ratio"